Metal and Steels

Petrochemical demand is increasing in Indonesia

Jun 14, 2024

Table of Content

- Petrochemical

- The return of petrochemicals still faces challenges compared to broader markets

- Petrochemical demand is increasing in Indonesia

Metal and Steels

Jun 14, 2024

The petrochemical industry processes raw materials from gas processing and oil refining into various products including plastics, synthetic fibers, fertilizers, adhesives, dyes, detergents, and synthetic paints. According to the IEA report, petrochemical feedstocks contribute to 12% of global oil demand, which is expected to increase alongside the rising demand for plastics, fertilizers, and other products.

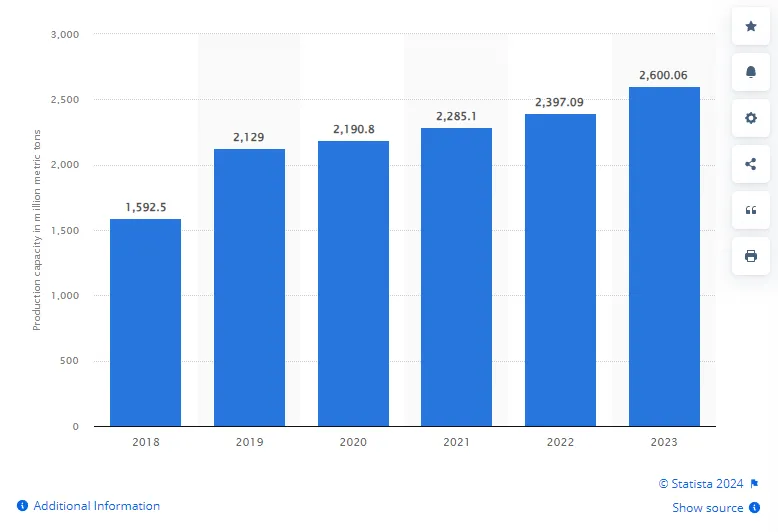

Statista reports that global petrochemical production capacity reached nearly 2.3 billion metric tons in 2022. It is expected to grow significantly by 2030, particularly in China, India, and Iran as countries with the largest additions to petrochemical capacity. Additionally, the global market value of this industry is projected to surpass one trillion US dollars. The increasing demand for products, coupled with the decline in liquid fossil fuels in the transportation sector, can make petrochemicals one of the largest drivers of oil demand in the near future.

Indonesia boasts the largest economy in Southeast Asia. The industry contributes the largest portion to the GDP (46.5 percent of the total GDP). Within the industry, the most important sector is manufacturing, which is one of the main growth engines (24 percent of total output). Mining and quarrying account for 12 percent, construction for 10 percent, and electricity, gas, and water supply for 0.75 percent. Services contribute 38 percent of the total GDP. In the service sector, the most important are: trade, hotels, and restaurants (about 14 percent of GDP); transportation and communication (7 percent of GDP); finance, real estate, and business services (7 percent of GDP); and government services (6 percent).

However, starting in the second half of 2022, supply chain disruptions eased and interest rates rose, causing retailers and other businesses to trim their elevated inventory levels. From a demand perspective, this poses barriers for upstream products, such as consumer goods and packaging. Similar to the "bullwhip effect," the loss of demand is more pronounced in upstream regions—especially impacting chemical industry players.

Although destocking has continued at the retail level since the second half of 2022, the end-market sector still faces increased inventory levels compared to pre-pandemic levels. For instance, consumer packaging and plastic and paper packaging industry players experience inventory levels 15 to 20 percent above pre-COVID-19 levels, indicating potential demand challenges in 2024.

In the second half of 2022 and entering 2023, shareholder value in the petrochemical industry remains relatively stable. In fact, the average TSR from the first quarter of 2022 to the third quarter of 2023 declined by about 10 percent, unlike the MSCI World Index. This highlights ongoing challenges amidst market challenges and low EBITDA margins. In Europe, companies grapple with deteriorating market conditions due to price and volume declines resulting from supply chain recovery and high energy prices. In Asia, oversupply and weak demand result in negative margins for key value chains, such as ethylene, polyethylene (PE), and polypropylene (PP). And in North America, the advantage of ethylene feedstock is partially offset by lower cash costs, as naphtha prices in Asia remain low due to a combination of weak gasoline demand and cracking, and stable solar demand keeps refinery utilization rates stable.

The Indonesian Ministry of Industry continues to focus on developing investments in the chemical industry to be able to substitute imported chemical materials and goods. As conveyed by IDN Financials, the Director General of Chemical, Pharmaceutical, and Textile Industry representing the Minister of Industry at the Inauguration of the Expansion and Expansion of PVC Plant stated that in 2021, the value of chemical raw materials and chemical goods exports reached USD 18.86 billion. He added that amid the pandemic and economic recovery, they will continue to improve the trade balance deficit in the chemical industry sector.

Government incentives to develop the mineral processing industry have driven investments of Rp 151.7 trillion (US$9.53 billion) this year, according to government data, including for the construction of nickel and copper smelters, but the Ministry of Industry said investment in the petrochemical industry is below standard. Investment in the construction of petrochemical processing facilities in Indonesia this year only reached Rp 31.6 trillion, less than downstream investments in forestry and agriculture (asia.network).

The global petrochemical industry is poised for significant growth by 2030, driven by increasing demand and substantial investments, particularly in countries like China, India, and Iran. This expansion is expected to make petrochemicals a major driver of oil demand. Despite this potential, challenges such as supply chain disruptions, inventory levels, and market conditions persist, impacting shareholder value and margins, especially in regions like Europe and Asia.

In Indonesia, the petrochemical sector is gaining traction, with the government focusing on developing investments to reduce dependence on imported chemical materials and goods. However, investments in the petrochemical industry remain below standard compared to other sectors like mineral processing. Government incentives are driving investments in mineral processing, including the construction of nickel and copper smelters, but efforts to boost the petrochemical industry are still lagging behind. Despite these challenges, there is a concerted effort to improve the trade balance deficit in the chemical industry sector amidst the pandemic and economic recovery.

We're committed to your privacy. Tradeasia uses the information you provide to us to contact you about our relevant content, products, and services. For more information, check out our privacy policy.

Leave a Comment